ABU DHABI, 14th May 2024 (WAM) — His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, and His Highness Sheikh Mansour bin Zayed Al Nahyan, Vice President, Deputy Prime Minister and Chairman of the Presidential Court, have sent congratulatory messages to Jeremiah Manele on his election as the Prime Minister of the Solomon Islands.

LATEST ARTICLES

DoH, M42 launch region’s largest hybrid cord blood bank

ABU DHABI, 14th May, 2024 (WAM) — The Department of Health – Abu Dhabi (DoH) and M42 have collaborated to launch the Abu Dhabi Biobank, with its first offering being the region’s largest hybrid cord blood bank.

Reinforcing the Emirate’s position as a leading destination for life sciences, the initiative aims to shorten waiting times for treatment, increase therapeutic access for patients, improve survival rates and reduce the economic burden on governments.

Announced at the inaugural Abu Dhabi Global Healthcare Week 2024 where M42 is participating as the Foundation Partner, the Abu Dhabi Biobank is part of the emirate’s vision of building a unique global biobanking hub delivering invaluable data assets for maximal impact on people’s health.

It will be a key pillar of health transformation and aims to deliver excellence by creating a diverse, foundational, bio-asset that supports therapeutic treatments, life science research for medical innovation, novel drug discovery targets and disease prevention to deliver the highest level of personalised, precise, and preventative healthcare for all.

The service will be introduced across four leading healthcare entities committed to maternal and child health across Abu Dhabi. Prospective parents can avail themselves of this service at Danat Al Emarat Hospital for Women & Children, part of the M42 group, Corniche Hospital, Kanad Hospital, and hospitals as part of NMC Healthcare.

Dr. Noura Khamis Al Ghaithi, Undersecretary of DoH, said that the wealth of biological and medical data amassed by the Biobank will catalyse scientific breakthroughs, expediting drug discovery, thus contributing to the Emirate’s ability to find solutions for local and global health challenges. It will significantly impact clinical care and patient outcomes, emphasising cord-derived stem cell therapies and enabling local stem cell therapy delivery.

She added, “The Abu Dhabi Biobank’s ability to link cord blood, tissue, stem cells, and a wide range of normal and pathological human specimens with established large genomic, proteomics and clinical records sets the scene for transformative and cutting-edge initiatives.”

An important advancement for the nation’s health ecosystem, the cord blood bank of Abu Dhabi Biobank will enable better care outcomes, build the nation’s self-sufficiency in meeting the urgent need for cord blood stem cells, and further enhance regional capabilities in research and innovation.

Stem cells work like a ‘bio repair kit’, helping to heal, restore and replenish other cells that can be used to treat certain haematological and immune system disorders, like leukaemia, lymphoma and bone marrow diseases requiring a transplant.

With a capacity to store 100,000 cord blood samples and five million pan-human samples, the Biobank will create a rich, diverse dataset that can provide ready and better-matched hemopoietic stem cells globally. It aims to enhance community well-being through preventive measures and access to advanced, high-quality health services.

Abu Dhabi Biobank’s cord blood bank facility, situated in M42’s Omics Centre of Excellence, is equipped with state-of-the-art automated technology and the best large-capacity biobanking infrastructure. This infrastructure will preserve samples safely and securely, thereby making them viable for research and therapeutic use for 30 years.

Ashish Koshy, Group Chief Operating Officer of M42, said, “The Abu Dhabi Biobank will foster global innovation in therapy development, as it holds huge potential for regenerative medicine, aiding in rare disease treatment, genetic screening, early detection, and scientific research. We’re proud to partner with DoH on this initiative, and we look forward to collaborating with them and other healthcare providers to drive progress in health and reinforce Abu Dhabi’s position as a global life science hub.”

The cord blood bank locally collects and preserves umbilical cord cells, offering donors the choice of preserving a newborn’s stem cells at birth, for potentially lifesaving treatments at no risk to them or their baby.

Expectant mothers can preserve their baby’s cord blood by opting for a safe, secure, painless, and non-intrusive process that can save lives and help build a healthier nation. They will have the opportunity to preserve the stem cells as part of public or private banking.

Mansour bin Zayed honours winners of second Nafis Award

On the occasion, Sheikh Mansour thanked the award’s winners and partners for supporting the council’s objectives, stressing that the award recognises exceptional establishments that support Emiratisation, honours national talents who have succeeded in their roles in the private and banking sectors, and promotes a culture of excellence and competition among citizens in the labour market.

He also lauded the positive competition witnessed during the award’s second edition, affirming that its primary goal is to support national talents in the private and banking sectors and encourage them to develop and grow in their professional careers.

Additionally, it aims to encourage competition among private sector establishments to increase their Emiratisation rates, in line with the UAE leadership’s vision and the government’s strategic plan to support Emiratisation initiatives in the private and banking sectors, he added.

Dr. Abdulrahman Al Awar, Minister of Human Resources and Emiratisation, highlighted the award’s importance in motivating national talents to achieve further professional success and recognising outstanding companies in the field of Emiratisation.

The Nafis Award crowns the efforts of private companies that successfully embodied the leadership’s vision to increase the participation of Emirati talent in the private sector across various fields and professional specialities, therefore, enhancing their contributions to sustainable economic development, he added.

For his part, Khaled Mohamed Balama, Governor of the Central Bank of the UAE (CBUAE), affirmed that the bank prioritises achieving Emiratisation and empowering citizens in the financial sector through integrated strategies and a sustainable Emiratisation system to create 5,000 job opportunities for citizens in vital and specialist positions across 22 educational pathways and 30 percent in leadership roles by 2026.

Furthermore, CBUAE aims to launch unique initiatives and programmes to expand the base of citizens working in the financial sector, including the “Ithraa” programme for Emiratisation in the banking, financial, and insurance sectors, which achieved exceptional results in its first year by exceeding its target for 2023, with the percentage of Emirati citizens in key positions in banks rising to 31 percent, and in the insurance sector to 23 percent, he further said.

Ghannam Al Mazrouei, Secretary-General of the ETCC, said the award’s second edition also witnessed a 98 percent increase in the number of self-nomination applications for the individual category compared to the first edition, which has helped to achieve the council’s goals of developing the skills of citizens working in this vital sector and encouraging them to continue their outstanding efforts, which in turn builds a culture of excellence and improves the performance of establishments.

The award provides an opportunity for citizens working in the private and banking sectors to participate and celebrate their efforts and professional excellence, he added.

During the ceremony, the ETCC announced the names of the winners of the award’s individual categories. In ten subcategories, 30 UAE citizens working in the private and banking sectors won the top three positions.

The ETCC also announced the names of winning establishments from 14 sectors registered under the Ministry of Human Resources and Emiratisation and the Central Bank of the UAE.

The ceremony was attended by several ministers, senior officials, business leaders, and public figures. The awards recognised the achievements of winners in both the individual and establishment categories for 2023, and honoured several establishments that made exceptional efforts to support Emiratisation, alongside the partners of the ETCC.

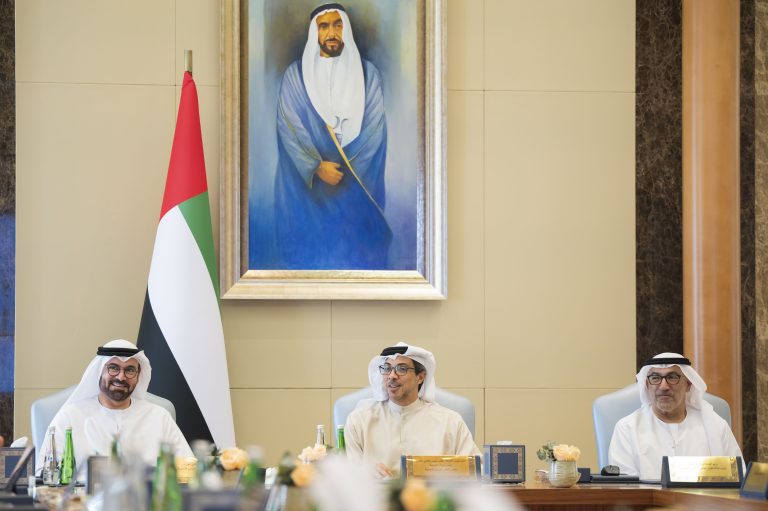

Mansour bin Zayed chairs Ministerial Development Council’s meeting, discusses several government initiatives, projects

ABU DHABI, 14th May, 2024 (WAM) — His Highness Sheikh Mansour bin Zayed Al Nahyan, Vice President, Deputy Prime Minister and Chairman of the Presidential Court, today chaired the Ministerial Development Council meeting, which took place at Qasr Al Watan in Abu Dhabi.

During the meeting, the Council discussed a number of initiatives, projects, and regulatory guides submitted by ministries and federal departments to promote government work and enhance the efficiency of strategic sectors in the country.

The Council also discussed the government guidelines related to regulating the public financial affairs of the federal government, in addition to a number of proposed national policies and projects in the fields of education, culture, digital transformation, artificial intelligence, and economy.

The meeting also reviewed reports and updates on the implementation of national strategies and policies across a number of sectors.

The Ministerial Development Council reviewed the requests and recommendations of the Federal National Council regarding a number of government topics, as well as the results of the country’s participation in international conferences and events.

UAE President receives participants in Abu Dhabi Global Healthcare Week

ABU DHABI, 14th May, 2024 (WAM) — President His Highness Sheikh Mohamed bin Zayed Al Nahyan today received at Qasr Al Bahr in Abu Dhabi several health ministers and officials participating in the inaugural Abu Dhabi Global Healthcare Week (ADGHW).

During the meeting, His Highness extended a warm welcome to the guests, joined by Mansour Ibrahim Al Mansouri, Chairman of the Department of Health – Abu Dhabi.

He wished them success in their contributions to this global event aimed at achieving outcomes that will form the basis for future strategic planning in the global health sector.

His Highness highlighted the significance of these gatherings for exchanging ideas and insights on the latest trends and technological advances shaping the global healthcare system. He also stressed the importance of developing innovative solutions to address challenges facing the health sector.

His Highness emphasised that the UAE is committed to supporting all efforts and initiatives aimed at advancing the future of healthcare and strengthening global health systems while also promoting investments in healthcare development for the greater good of humanity.

Participants expressed their appreciation to the UAE and the organisers of the Abu Dhabi Global Healthcare Week, which provides a vital platform for dialogue and the exchange of ideas on future healthcare needs and strategies for advancing healthcare through a proactive and preventive approach.

Journey Through Global Flavours at the Queen Elizabeth 2 Hotel in Dubai

Step aboard the legendary Queen Elizabeth 2 Hotel in Dubai, where history and gastronomy come together in a symphony of unforgettable experiences. From the sea-view charm of the Lido Restaurant to the royal flair of the Queen’s Grill, each venue offers a unique gastronomic adventure. This summer, we are excited to unveil a series of tempting dining offers that cater to every taste and occasion. Whether you’re seeking a delicious dinner buffet, an indulgent afternoon tea, or a culturally immersive Dine & Explore tours, the Queen Elizabeth 2 Hotel promises an unforgettable culinary journey, blending its rich history with delicious local and internationl flavours.

Royal Afternoon Tea

Experience our quintessential afternoon tea in royal style at the Queens Grill restaurant, a venue once reserved for first-class passengers. Indulge in an exquisite assortment of savoury bites, freshly baked scones and a selection of pastries. Enjoy a unique English tea experience in the heart of Dubai. Choose between Cunard afternoon tea, featuring cold bites and pastries, and Britannia afternoon tea, featuring cold and hot canapes and pastries.Vegetarian, vegan and gluten-free options are available upon request. Please inform our team when booking.

§ Available Fridays and Saturdays between 3:00 pm – 6:30 pm

(Last seating at 5:00 pm).

§ Cunard Package

AED 175 per person / AED 125 per child (8 – 12 years old)

§ Britannia Package

AED 225 per person / AED 145 per child (8 – 12 years old)

§ Dress Code: Smart Casual (no shorts or flip-flops).

§ Guests must be above 8 years old to enjoy the Afternoon Tea.

Please note that a 24-hour advance booking is required.

All our prices are in AED inclusive of 5% VAT, 7% municipality fee and 10% service charge.

§ For inquiries, please contact us on +971 4 526 8888 / +971 600 500 400 or reservations.qe2@accor.com

Pub Favourites

Whether you’re craving the golden crunch of our fish and chips or the juicy sizzle of our classic burgers, we’ve got your pub favorites and laid-back snacks waiting at the Golden Lion!

§ Enjoy 50% discount on selected beverages during the Golden Hour from 4:00 pm to 8:00 pm (Not available on the occasion of key events).

§ Cheers & Bites

Wings or Calamari paired with 2 selected Bottled Malt Beverages

AED 105 per person

§ Mix Platter Extravaganza!

Dive into our Mix Platter featuring, Crispy Prawn Tempura, Irresistible BBQ Chicken Wings, Delightful Vegetable Spring Rolls, and Perfectly Crisped Onion Rings.

AED 55 per person

§ For inquiries, please contact us on +971 4 526 8888 / +971 600 500 400 or reservations.qe2@accor.com

Afternoon Tea & Heritage Tour

Enhance your afternoon tea experience at the Queens Grill restaurant by combining it with a captivating tour onboard the iconic Queen Elizabeth 2 Hotel. Step back in time and discover the rich British heritage, intricate design and engineering, and fascinating maritime history of this legendary vessel while indulging in a delightful assortment of savory bites, freshly baked scones, and a variety of pastries. You can opt for the Cunard afternoon tea, which includes cold bites and pastries, or the Britannia afternoon tea, which features a mix of cold and hot canapés and pastries.

§ Friday & Saturday

3:00 pm – 5:00 pm Afternoon Tea

5:00 pm – Heritage Tour

§ Heritage Tour + Cunard Afternoon Tea

AED 225 per person / AED 175 per child (8 – 12 years old)

§ Heritage Tour + Britannia Afternoon Tea

AED 275 per person / AED 195 per child (8 – 12 years old)

§ *Offer is subject to availability

§ For inquiries, please contact us at +971 4 526 8888 or tours.qe2@accor.com

International Dinner Buffet at Lido Restaurant

The large windows overlooking the Arabian Gulf evoke memories of maritime travel and set the stage for a relaxed dining experience at the historic Lido Restaurant at Queen Elizabeth 2 Hotel. Enjoy an indulgent buffet dinner featuring a wide variety of delectable international favourites. Buffet highlights include hearty salads, a wide selection of sumptuous exotic and international main dishes and decadent spread of desserts.

· AED 155 per person

· Daily at Lido Restaurant

· 6.30 PM – 11:00 PM

Corporate & Group offers are available

Prices are in AED and are inclusive of 10% service charge, 7% municipality fees and 5% VAT.

For more details and bookings

Phone: +971 4 526 8040 I Email: dining.qe2@accor.com

Dine & Explore

Step on board and back in time to discover the rich heritage of Queen Elizabeth 2. Our Heritage Tour is the perfect way to explore this iconic vessel. Complete your experience on board the QE2 with lunch after the 11:00 am tour or dinner after the 5:00 pm tour at Lido restaurant.

3-Course Lunch

Monday to Thursday, 11:00 am Tour followed by Lunch

§ 3 Course Lunch

§ Lido Restaurant

§ AED 150 per person (including a 3-course meal)

§ AED 90 per child (6 – 12 years old)

Friday to Sunday, 11:00 am Tour followed by Lunch

§ 3 Course Lunch

§ Lido Restaurant

§ AED 180 per person (including a 3-course meal)

§ AED 110 per child (6 – 12 years old)

Buffet Dinner

§ Buffet Dinner

§ Monday to Sunday

§ 5:00 pm tour followed by buffet dinner

§ AED 195 per person (including buffet)*

§ AED 90 per child (6 – 12 years old)

Terms & Conditions Apply

*Offer is subject to availability

*The offer is available for a maximum of 10 guests and not applicable to larger groups.

For bookings and inquiries, please contact us at

+971 4 526 8888 or tours.qe2@accor.com

-End-

About Queen Elizabeth 2 Hotel, Managed by Accor

Queen Elizabeth 2 Hotel, managed by Accor, is a historic gem and the only floating hotel in emirates. Located in Port Rashid, in close proximity to Dubai’s main attractions and shopping malls, its 447 renovated rooms and suites are carefully decorated, offering a peaceful retreat in which to relax and unwind.

Guests can experience a culinary journey with innovative menus onboard the QE2. The hotel’s dining outlets include Lido – an all-day dining restaurant; The Golden Lion – the oldest pub in Dubai; The Pavilion – an alfresco lounge; and the Queens Grill – serving Afternoon Tea.

For those seeking an event with a difference, the iconic QE2 offers multiple one-of-a-kind venues in Dubai. Included in its facilities are unique indoor and outdoor event spaces. Whether you are planning a birthday bash, an anniversary party, a wedding celebration, or any other social or corporate functions, the QE2 provides an inspiring and impressive backdrop that will delight your guests.

For reservations & Inquiries

Call +971 4 526 8888 or email Reservations.qe2@accor.com

Or visit https://www.qe2.com

For Media Inquiries contact:

Hina Bakht

Managing Director

EVOPS Marketing & PR

Mob: 00971 50 6975146

Tel: 00971 4 566 7355

Ajman Bank sets New Record Jumping to 117.1 million up by 139% profit before tax (AED 107.4 million net profit)

Ajman Bank has reported an all time high quarterly profit in Q1 2024 of AED 107.4 million. This is on the back of a 7.0% increase in total operating income to AED 400.3 million as compared to AED 374.0 million in corresponding period of 2023, and net operating income of AED 194.8 million. Return on shareholder Equity (annualized) and Return on Asset (annualized) have doubled in Q1 2024 as compared to corresponding period of 2023 – respectively to 15.5% (up by 7.9%) and 1.9% (up by 1.0%).

His Highness Sheikh Ammar bin Humaid Al Nuaimi, Crown Prince of Ajman, Chairman of Ajman Bank, “Our strong financial performance in the first quarter of 2024 is a testament to the success of our transformation agenda committing to our shareholders, investors and clients enhancing our operational excellence. We have made significant progress, which underscores our strong market position. I extend my deepest gratitude to our team, whose dedication and hard work have been integral to our success.”

Mr. Mustafa Al Khalfawi, CEO of Ajman Bank, stated, “We have made significant progress, which underscores our strong market position and the substantial gains in shareholder equity and asset returns. Our first-quarter results are a clear reflection of our transformative journey, which has strategically propelled our expansion and diversified our business profile. We’ve focused on enhancing the continued value to our shareholders and supporting the economic landscape of the UAE. In addition to stringent cost containment and operational efficiencies within a resilient framework, emphasizing digital innovation and customer service excellence. Our rigorous approach to risk management and our commitment to addressing regulatory challenges have been crucial. Moreover, we are enhancing our leadership team with strategic talent to ensure that Ajman Bank is well-equipped to navigate future challenges and opportunities in the market.

The strong results are supported by a healthy balance sheet with Total Assets of AED 23.1 billion and AED 2.8 billion of Equity. Ajman Bank’s Capital adequacy ratio of 16.6% (up by 1.4%) and a Tier 1 Capital adequacy of 15.5% (up by 1.4%) remain well above regulatory requirements. Customer deposits of AED 19.3 billion, an advance to stable resources ratio of 76.3%, and an eligible liquid asset ratio of 21.0%, underline its solid liquidity and along with the capital position provide a strong foundation for continued growth.

This strong financial performance was delivered thanks to continued focus on expanding the customer base, enhancing the credit quality, risk management and focus on recoveries. The bank opened 2195 new accounts, 26% of them opened through digital channels. The bank also launched ‘Ajman Connect’ the new digital application with continued focus on digitizing and streamlining its end to end processes.

In line with it’s commitment toward sustainability, Ajman bank published its first sustainability report. The bank baselined its carbon emission across all operations and locations and which will pave the way for systematic tracking and reduction in the banks carbon footprint going forward.

The bank is confident that the solid foundation on the back of it’s strong Q1 2024 results, the ongoing transformation and the strength of the UAE economy will help it maintain a strong monentum for growth and continued profitability through 2024 and beyond.

-End-

About Ajman Bank

Ajman Bank is an Islamic bank with an ambitious vision based on values of integrity, trust and transparency seeks to provide a wide range of Sharia-compliant and high-quality banking services to customers from individuals, companies and government institutions across the UAE. It is also keen to be updated with the latest technology that will ensure customers a distinctive experimental banking with the revival of human touch that is lost in the modern era of banking application.

Ajman Bank is headquartered in Ajman and enjoys the strong support of the Government of Ajman and is a key pillar in the emirate’s economic development strategy. The bank continues its tireless efforts to establish a prominent position in the banking sector as a sustainable Islamic banking institution, with an emphasis on the need to achieve an optimal balance in the community and caring staff, in order to provide real value for shareholders and customers alike. For more information visit http://www.ajmanbank.ae

Dubai FinTech Summit concludes with over 8,000 visitors from 118 countries

- The 3rd edition of the Dubai FinTech Summit to be held on 7-8 May 2025, under the directives of His Highness Sheikh Maktoum.

- The 2nd edition of Dubai FinTech Summit attracted over 8,000 visitors from 118 countries around the world.

- Over 50 Memorandum of Understandings (MoUs) were signed during the Summit with global financial leaders.

- More than 20 top investment management firms with investments in 12,000 companies participated in the Summit.

· Nik Storonsky, Founder and CEO of Revolut inked expansion plans in the MEASA region, marking a significant step towards fostering financial inclusion through cutting-edge technology.

· State Street Global Advisors’ President and Chief Executive Officer, Yie-Hsin Hung confirmed the reopening of its Dubai offices.

- Dyna.Ai, the Singapore headquartered firm launched operations across Asia, the Middle East, Africa, Europe, North America and Latin America, with offices planned in the UAE, Saudi Arabia, and Nigeria.

Dubai, 8 May 2024: The 2nd edition of Dubai FinTech Summit (DFS) organised by Dubai International Financial Centre (DIFC), under the patronage of His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai, Deputy Prime Minister and Minister of Finance of the UAE, and President of DIFC, concluded with resounding success. The 3rd edition of the Dubai FinTech Summit will be held on 7-8 May 2025, also under the directives of His Highness Sheikh Maktoum.

From government officials and policy makers to start-up founders, the two-day Summit, held at Madinat Jumeirah, brought together an unprecedented gathering of more than 8,000 decision-makers from 118 countries around the world. These included over 300 thought leaders participating in 125 discussions across five stages and over 200 exhibitors showcasing cutting-edge technologies. Over 20 government dignitaries were also in attendance, including the Mayor of Seoul, Central Bank Governors, and Deputy Governors.

His Excellency, Essa Kazim, Governor of DIFC, commented: “The Dubai FinTech Summit is not just a gathering, it is a platform for transformative discussions and collective action. The Dubai FinTech Summit stands as a beacon of impact, progress, and collaboration, creating unprecedented opportunities for growth and innovation. Dubai is at the forefront of shaping the future of finance and will continue to strengthen its position as a leading global hub for FinTech firms.”

Arif Amiri, Chief Executive Officer at DIFC Authority, opened day two of the Summit, followed by two fireside chats with His Excellency Helal Saeed Al Marri, Director General, Department of Economy and Tourism, and Yie-Hsin Hung, President and Chief Executive Officer at State Street Global Advisors.

During his opening remarks, Arif Amiri, Chief Executive Officer at DIFC Authority, said: “Today, we are experiencing an extraordinary period of technological transformation where FinTech defines how we transact, how we save, and how we manage our financial lives. FinTech is also defining how traditional financial services companies operate. In recent years, we have seen FinTech revenues grow globally six-fold. We have also seen growing mainstream acceptance of cryptocurrencies, which is allowing for its market capitalisation to exceed USD 3trn. This year, FinTech is again expected to garner and secure an additional 5 per cent of global financial service revenues. In the next two years, digital payments are expected to increase over 10trn dollars, and by 2030, north of 25 per cent of banking valuations are expected to be driven by FinTech.

Dubai FinTech Summit offers a unique platform to explore the opportunities ahead of us, which is why, at DIFC, our strategy is firmly focused on being at the heart of this FinTech revolution. During our 20 years of operations, we have always embraced innovation. It is part of our X factor. We do not simply talk about it but engage with it; with the talent, with the investors and the regulators to execute it. Our visionary leadership has always enabled Dubai and DIFC to take a leading role in driving the future of finance and innovation. For this reason, we have built the region’s most comprehensive proposition that enables our clients to do and achieve great things in a place that integrates FinTech firmly into its DNA. In a place that attracts talented entrepreneurs, encourages collaboration, and provides global connectivity: a gateway between the east and the west, and a true nexus point for the global markets.”

Over 50 international associations participated in the Summit this year, including Africa FinTech Network, Business France, FinTech Philippines Association, European Blockchain Association, Global FinTech Alliance (GFA), Hong Kong FinTech Industry Association, International Digital Economy Association, Invest Seoul, Luxembourg Institute of Financial Technology (LHOFT), Swiss Finance & Technology Association and Women in Web3 Association, among others.

This year’s Summit saw the participation of over 1,000 investors, including more than 10 top executives from some of the world’s biggest banks, managing over USD 7trn in assets under management (AUM). In addition, over 40 FinTech and blockchain unicorns, with a combined market capitalisation of over USD 400bn were also present.

During the two days, over 30 side events were hosted by local, regional, and international partners of the Summit. Panels on the second day included a deep dive into some of the most pressing topics within the financial technology landscape, ranging from High Interest Rates and Macroeconomic Volatility, Institutional Adoption and Regulatory Clarity – Crypto’s Path Forward, and D33 – A Decade of Economic Transformation, among others.

Dubai FinTech Summit also witnessed the signing of more than 50 Memorandum of Understandings (MoUs) with global financial leaders, as well as several key announcements from attending businesses.

Nik Storonsky, Founder and CEO of Revolut announced expansion plans in the MEASA region, marking a significant step towards fostering financial inclusion through cutting-edge technology. Revolut is a global neobank and financial technology company with headquarters in the UK that offers banking services for retail customers and businesses.

Recognising the potential of operating in the region’s largest financial ecosystem, State Street Global Advisors’ CEO, Yie-Hsin Hung, also announced that the firm is making a welcome return to DIFC. Based on the region’s expanding opportunities, coupled with DIFC’s 20-year track record as a leading hub for finance and growth, DIFC has continued to draw in an extensive list of banks, advisors, high-net-worth individuals, family offices, and sovereign wealth funds seeking exposure to the region’s fast-growth markets within a future-forward regulated environment.

Dyna.Ai, the Singapore-headquartered firm announced the launch of its operations across Asia, the Middle East, Africa, Europe, North America and Latin America, aiming to transform businesses with AI. The company offers a suite of solutions for digital banking, risk management, audience communication, and employee productivity to address current financial challenges. In the MEA region, offices will be opened in the UAE, Saudi Arabia, and Nigeria. Dyna Athena, a newly launched AI platform, will provide revolutionary communication and interaction between customers, which will include features such as text-to-speech, language and speech processing. Dyna Avatar, a brand-new humanoid customer assistant, capable of real-time voice-activated conversations in Arabic, English, Chinese, Japanese and Thai, was also launched at the Summit.

Among several notable presentations, Crypto Oasis provided an insightful update on the UAE’s dynamic and ever-evolving blockchain ecosystem. According to the presentation, active companies have surged by 13 per cent year-on-year, reaching 2,040 organisations, with a healthy mix of 71 per cent native and 29 per cent non-native blockchain companies contributing to the ecosystem. There has also been a marked increase in the industry workforce, with over 10,600 individuals working in the blockchain space. One of the key factors driving the crypto industry has been an increase in regulatory clarity, which has helped to attract global brands such as Bybit, Crypto.com, and OKX, which each received Virtual Asset Service Provider (VASP) licenses from VARA.

In line with the Dubai Economic Agenda (D33) to position Dubai as the top four global financial hubs by 2033, DFS is designed to encourage cross-border collaboration and innovation, central to transforming the global FinTech sector. The Summit presented a unique opportunity for attendees to explore emerging FinTech trends and their potential to drive financial progress in the MEASA region.

The 2nd edition of the Dubai FinTech Summit was supported by over 150 global corporate partners. Visa as Founding Partner & Co-Host; Emirates NBD as Premium Banking Partner; e& life as Powered By sponsor; Commercial Bank of Dubai (CBD) as Strategic Banking Partner; Finvasia as Lead Sponsor; SC Ventures as Strategic Venture Partner; Dynatech AI as Powered By sponsor; and Mashreq as Diamond Sponsor, among others.

END

About Dubai FinTech Summit

Dubai FinTech Summit is an annual mega event organised by the Dubai International Financial Centre (DIFC), the leading global financial centre in the Middle East, Africa and South Asia (MEASA) region. The 2nd edition of the Dubai FinTech Summit will bring together over 8,000+ global industry leaders, 1,500+ investors and policy makers, signalling increased appetite for growth opportunities in the region.

Dubai FinTech Summit signals new wave of financial innovation, opportunity, transformation, and growth for the international financial services sector. As a rising FinTech hub, Dubai is also spearheading the evolution of the financial services industry, with investments in FinTech projected to grow by 17.2 per cent CAGR to USD949 billion from 2022 to 2030. The Summit aligns with the Dubai Economic Agenda D33’s strategic goal of propelling Dubai into the ranks of the top four global financial hubs by 2033.

The expanded programme of Dubai FinTech Summit is set to exceed expectations by delving into key tracks, including the future of FinTech, embedded and Open Finance, climate finance, Web3 and digital assets. The summit stands as a thought leadership-driven platform, addressing industry challenges head-on and championing innovation.

Visit www.dubaiFinTechsummit.com

#Difc #DifcInnovationHub #DFS2024 #FinTech

For further enquiries, please contact:

Samia Ahmad

Assistant Manager, Marketing at DIFC Innovation Hub

E: samia.ahmad@difc.com

Phone: +971 4 362 2657

Governor State Bank of Pakistan, Mr. Jameel Ahmad, Shares Pakistan’s Economic Success Story at AIM Congress 2024

Governor State Bank of Pakistan, Mr. Jameel Ahmad participated in the roundtable panel discussion of Central Banks Governors and Presidents of Stock Exchange markets of different countries, at Annual Investment Meeting (AIM Congress) 2024 in Abu Dhabi.

He shared Pakistan’s perspective in successfully dealing with macroeconomic challenges and highlighted the efforts made towards stabilizing Pakistan’s economy and building investor’s confidence.