Global growth prospects have weakened significantly amid the war in Ukraine

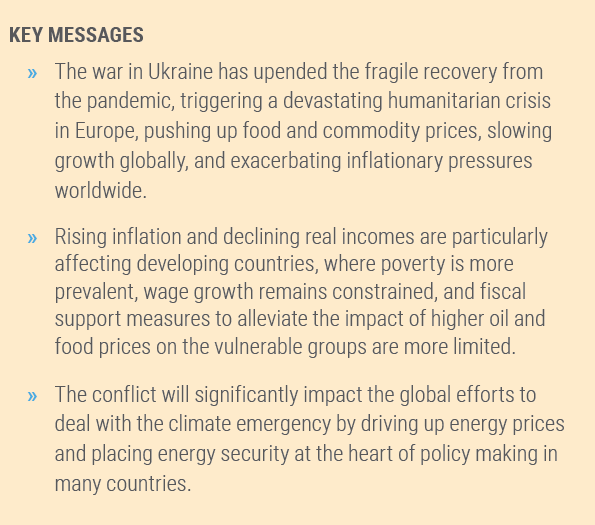

The World Economic Situation and Prospects as of mid-2022 warns that the global economy may be on the cusp of a new crisis, while still recovering from the pandemic. The war in Ukraine has upended the fragile global recovery, triggering a devastating humanitarian crisis in Europe, pushing up food and commodity prices, slowing growth globally and exacerbating inflationary pressures worldwide. Geopolitical and economic uncertainties are dampening business confidence and investment and further weakening short-term economic prospects. Against this backdrop, the world economy is now projected to grow by only 3.1 per cent in 2022 and 2023 (figure 1), marking substantial downward revisions of 0.9 and 0.4 percentage points, respectively, from our previous forecasts released in January 2022. Our baseline outlook faces major downside risks from further intensification of the war in Ukraine, new waves of the pandemic, and faster-than-expected monetary tightening by developed country central banks.

The downgrades in growth prospects are broad-based. Growth in the United States is forecast to slow to 2.6 per cent in 2022 due to high inflationary pressures, aggressive monetary tightening by the Federal Reserve and a strong US dollar, which is weighing on net exports. In China, GDP is projected to expand by 4.5 per cent, a downward revision of 0.7 percentage points, with stringent zero COVID-19 policies adversely affecting growth prospects. Meanwhile, there is an exceptionally heavy toll on the economy of the European Union: its GDP is projected to expand by 2.7 per cent in 2022, 1.2 percentage points lower than expected in January.

The economic prospects for the Commonwealth of Independent States and Georgia are also sharply downgraded. The Russian Federation’s economy is projected to contract by about 10 per cent in 2022. Amid massive destruction of infrastructure, population displacement and disruption of economic activities, the Ukrainian economy is projected to contract by 30 to 50 per cent in 2022.

The outlook for developing countries has also deteriorated, with GDP projected to increase by 4.1 per cent in 2022, 0.4 percentage points lower than forecast in January. Higher energy and food prices, rising inflationary pressures and slowing growth in the United States, the European Union and China are weakening their growth prospects. The monetary tightening in the United States will sharply increase their borrowing costs. A growing number of developing countries – including several least developed countries – face stagnant growth prospects and rising risks to sustainable development, amid high levels of debt distress. The negative outlook is compounded by worsening food insecurity, especially in Africa and Western Asia. Additionally, lower vaccination rates make developing countries more vulnerable to new waves of COVID-19 infections. By the end of April 2022, the number of doses per 100 people in the developed countries stood at 190.8, compared to 143.5 in developing countries and only 35.5 in Africa.

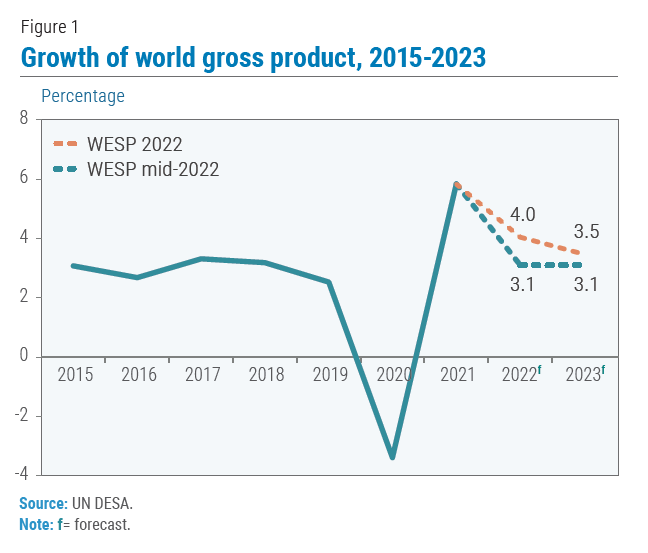

The war in Ukraine and the sanctions against the Russian Federation have rattled commodity markets, exacerbating supply-side shocks. In 2022, global trade growth is projected to slow down markedly, after a strong rebound in 2021. The conflict has directly disrupted exports of crude oil, natural gas, grains, fertilizer and metals, pushing up energy, food and commodity prices (figure 2). The Russian Federation and Ukraine are key suppliers of agricultural goods, accounting for 25 per cent of global wheat exports, 16 per cent of corn exports and 56 per cent of exports of sunflower oil.

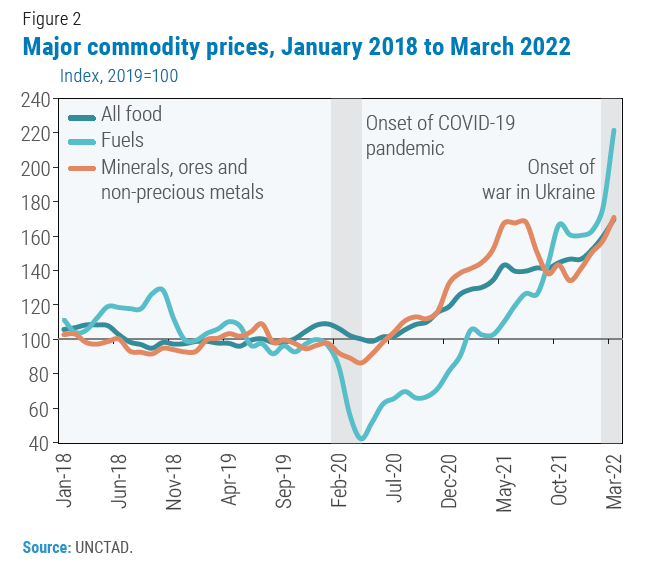

The world economy is facing substantial inflationary pressures. Global inflation is projected to increase to 6.7 per cent in 2022, twice the average of 2.9 per cent recorded during 2010–2020 (figure 3). Headline inflation in the United States has reached the highest level in four decades. In developing regions, inflation is rising in Western Asia and Latin America and the Caribbean. Soaring food and energy prices are having knock-on effects on the rest of the economy, as reflected in the significant rise in core inflation in many economies as well.

Rising inflation is posing an additional challenge to an inclusive recovery as it disproportionally affects low-income households that spend a much larger share of their income on food items. The decline in real incomes is particularly pronounced in developing countries, where poverty is more prevalent, wage growth remains constrained, and fiscal support measures to alleviate the impact of higher oil and food prices on the vulnerable groups are more limited. Surging food inflation is worsening food insecurity and pushing many below the poverty line as developing countries are still struggling with economic shocks from the pandemic.

The impact of the war in Ukraine on global climate action

The war in Ukraine unfolds at a time when global CO2 emissions are at an all-time high, having resumed their upward trend after a temporary drop in the first half of 2020 due to responses to the COVID-19 pandemic. Total greenhouse gas (GHG) emissions in 2019 reached about 59 gigatonnes of carbon dioxide equivalent (GtCO2-eq) units. The remaining carbon budget, consistent with a 50 per cent chance of limiting global warming to 1.50C, has been assessed at 500 GtCO2-eq units, making short-term increases in emissions even more problematic. Emissions will likely increase, for example, if there is a net replacement of natural gas – a relatively clean fossil fuel – with coal in energy production; or if food price increases prompt a reduction in biofuel use or the clearing of land to increase agricultural production; or if military spending, normally associated with large GHG footprints, increases substantially.

In the medium to longer term, the outlook for GHG emissions will depend on several factors. Sustained price increases in energy markets could accelerate the adoption of renewables and more efficient alternatives, but could also incentivize oil and gas companies, seeking to maximize profits, to ramp up investments in fossil fuels resulting in additional stranded assets. On the other hand, increases in the cost of production of batteries or supply chain issues could undermine demand for electric vehicles.

The war in Ukraine is reshaping the global energy landscape

The war in Ukraine and the wide-ranging economic sanctions imposed on the Russian Federation are expected to fundamentally reshape the global energy landscape. The conflict has roiled energy markets worldwide and propelled energy security concerns to the forefront. Governments around the world have put in place measures to shield households and businesses from the effects of energy price increases. In addition to direct income support to low-income households, these measures include cuts in value-added taxes on energy consumption, energy price caps, fuel rebates and cost subsidies. Germany, France, Italy, and Spain, for example, have announced energy support measures worth a combined €80 billion. Artificially low energy prices distort incentives for households and businesses to consume less energy. In addition, poorly targeted energy subsidies can strain scarce budgetary resources and be politically difficult to reverse.

In response to escalating prices, many countries are looking to expand domestic energy supplies. In the short run, these efforts will likely result in increased fossil fuel production. In the United States, the world’s largest producer of oil and natural gas, higher prices and growing energy security concerns have prompted an increase in drilling activities. In mid-April, the US rig count, which measures the number of active oil wells, was 58 per cent higher than a year ago. Meanwhile, the U.S. Government has announced the release of 1 million barrels of crude oil every day for the next six months from its Strategic Petroleum Reserve to bring energy prices down.

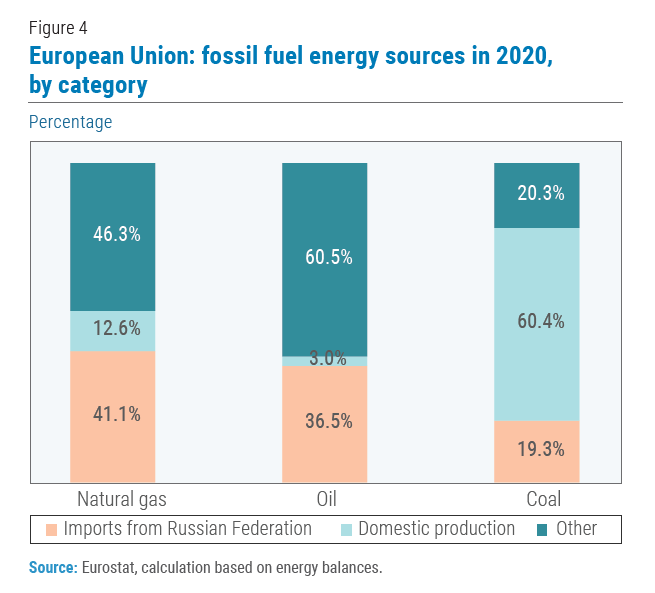

In Europe, geopolitical and energy security concerns have moved to the top of the political agenda amid the spike in energy prices. The war has led many governments to reconsider their energy policies and their energy dependence on the Russian Federation. In 2020, the Russian Federation accounted for about 41 per cent of the European Union’s natural gas imports, 37 per cent of oil imports and 19 per cent of hard coal imports (figure 4). For Germany, which is set to completely phase out nuclear power by the end of 2022, Russian gas accounted for 65 per cent of total gas imports in 2020. An immediate cut to gas supplies from the Russian Federation without alternative arrangements would have severe repercussions, potentially triggering a deep recession in countries like Germany.

A move to eliminate or reduce imports of Russian gas would mean a scramble for alternatives to minimize economic disruption. In the medium term, the EU could turn to other energy exporters. This will, however, require the EU to quickly resolve infrastructure bottlenecks in pipelines, storage terminals and tankers. Imports of natural gas, which is the least polluting of all fossil fuels, could also partly be replaced by oil and coal. Within Europe there is also renewed interest in nuclear power as a way to decrease reliance on Russian oil and natural gas. It is also likely that the Russian Federation would find new markets for fossil fuels in East and South Asia, where its oil and gas exports could replace coal, the dirtiest fossil fuel. In East and South Asia, coal continues to play a dominant role in the energy mix.

High energy prices will also likely boost investments in renewables and energy efficiency, potentially supporting the shift away from fossil fuels. In many countries, solar energy has already become the cheapest form of new electricity. According to a recent report, 62 per cent of total renewable power generation added in 2020 had lower costs than the cheapest new fossil fuel option. Unit costs for other renewables such as onshore and offshore wind and concentrating solar power are also below fossil fuel costs. Earlier periods of high fossil fuel prices, however, also led major oil and gas producers to ramp up investment in fossil fuel infrastructure. Similar responses at this time – including short-term policy measures – could lock the world into a high-carbon future. But since continually falling prices of renewables and multi-stakeholder commitments to climate action are increasing the risk of stranded assets, energy and financial firms may be more reluctant now to invest in new fossil fuel projects.

Challenges to vehicle electrification amid potential mineral shortages

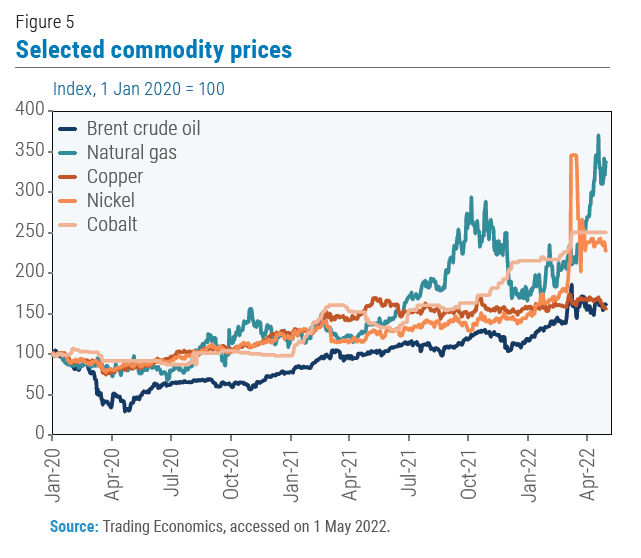

The war in Ukraine has also shaken global markets for metals (figure 5), with potential knock-on effects on the price of renewables. An average electric-car battery, for example, contains about 80 pounds of nickel. Nickel prices have increased by about 50 per cent compared to last year, as the Russian Federation processes 20 per cent of the world’s high-grade nickel. High nickel prices may also have adverse environmental impacts as the prospects of higher profit will likely encourage the production of additional nickel from polluting and environmentally destructive strip-mining, including from the rainforests of Indonesia and the Philippines. Overall, the price of a basket of EV battery metals rose by 64 per cent compared to last year, which could raise the final price of an EV by up to $2,000 and slow down EV sales. This has exposed the vulnerability of EVs to price shocks in essential metals, on top of pandemic-related supply chain problems.

The net effect of the conflict on clean-energy products will largely depend on how well manufacturers manage to secure supplies of critical minerals, invest in new processing plants, and recycle battery materials. To ensure access to critical minerals, the 31 member countries of the International Energy Agency (IEA) launched a critical minerals security program in March 2022 that could include the stockpiling of metals needed for EVs and other renewable energy infrastructure, similar to IEA members’ strategic stockpiles of oil.

Challenges for climate action from rising food prices

Sustainable biofuels (ethanol, biodiesel and renewable diesel) are important fossil fuel substitutes for land-based transport and are critical to achieving net zero scenario. Globally, 13 per cent of corn production and 20 per cent of global sugar cane production go into ethanol production, while 11 per cent of global vegetable oil production is used for biodiesel. The war has pushed up food prices, especially for items such as wheat, corn and vegetable oil, as the Russian Federation and Ukraine are major producers and exporters of these commodities.

Growing food and energy security concerns are raising questions about the use of food crops for biofuel. Croatia, Finland, and Sweden, for example, recently relaxed biofuel blending mandates to reduce energy price pressures. The US administration, on the other hand, is studying whether waiving biofuel blending mandates could help offset the surge in grain prices, while in the meantime extending the availability of higher biofuel blends of gasoline during the summer to curb high fuel costs. Carbon intensity of land transport will likely increase considerably should biofuel use decline during the current episode of high food prices. In the EU, a reduction of 0.4 percentage points in the proportion of biofuels used could lead to an increase in emission intensity of road transport fuels of 0.6 per cent.

Higher food prices could also lead to the intensification of agricultural practices and the expansion of agriculture into lands left fallow or under forest cover. For example, in March, European officials agreed to let farmers grow food and sow crops on fallow land. With land use change being a significant contributor to GHG emissions (about 10 per cent of the total in 2019), effects such as these could draw further from a dwindling carbon budget.

National and global support for climate action

Expectations that G20 stimulus spending during the COVID-19 pandemic would support mitigation efforts – and contribute to reducing emissions – have not materialized. Only about 6 per cent of total stimulus spending went to reducing emissions, including electrifying vehicles, making buildings more energy efficient and installing renewables. Faced with the Ukraine conflict, with energy and food security concerns dominating the policy discourse, climate change challenges have taken a backseat. The sixth assessment report of the UN Intergovernmental Panel on Climate Change (IPCC), however, emphasized that the world is running out of time to avoid catastrophic global warming.

While climate action may possibly face obstacles in the short term, it remains critical to scale up efforts to deliver on the Paris Agreement on climate change and the 2030 Agenda for Sustainable Development. A greater political and stakeholder impetus towards energy decarbonization can arise from the recognition of its link to energy and national security. At the same time, the conflict in Ukraine highlights the complex relationships among energy and food security, climate change and sustainable development. The crisis presents a new, and unique, opportunity to address these complexities with appropriate policies, targeted investments, policies and international cooperation in order to accelerate the transition towards sustainability, while minimizing the costs of such transition.

Sources:

Al Root (2022). Soaring nickel will drive Tesla, EV players to do this with batteries. Barron’s, 20 March.

European Environment Agency. Greenhouse gas emission intensity of fuels and biofuels for road transport in Europe.

G. Sgaravatti, S. Tagliapietra and G. Zachmann (2022). National policies to shield consumers from rising energy prices, Bruegel Datasets.

G. Wagner (2022). The right way to help people hurting from high energy prices, Bloomberg, April.

Intergovernmental Panel on Climate Change (IPCC) (2022). Climate Change 2022 – Mitigation of Climate Change, Working Group III Contribution to the IPCC Sixth Assessment Report (AR6), Summary for Policymakers.

International Energy Agency (2021). Coal 2021 – Analysis and forecast to 2024.

International Energy Agency (2021). Renewables 2021 – Biofuels.

International Renewable Energy Agency (IRENA) (2021). Renewable Power Generation Costs in 2020.

J. Tolleson (2022). What the war in Ukraine means for energy, climate and food. Nature, 5 April.

Jonas M. Nahm, Scot M. Miller and Johannes Urpelainen. G20’s US$14-trillion economic stimulus reneges on emissions pledges. Nature, 603(7899): 28–31.

József Popp, Mónika Harangi-Rákos, Zoltán Gabnai, Péter Balogh, Gabriella Antal, and Attila Bai (2016). Biofuels and their Co-Products as Livestock Feed: Global Economic and Environmental Implications.

Nature (2022). European Union can break free from Russia’s fossil fuel. Vol. 604, 7 April.

S. Müller-Dreizigacker (2022). Von der Pandemie zur Energiekrise – Wirtschaft und Politik im Dauerstress. Gemeinschafts-Diagnose.