SHARJAH, 4th June, 2024 (WAM) — A Sharjah delegation to the People’s Republic of China recently participated in high-level meetings with senior Chinese officials to explore cooperation opportunities and strengthen economic, cultural, and academic ties during their first stop in the capital of Beijing.

Led by the Department of Government Relations (DGR), the delegation, comprising 18 departments and institutions representing Sharjah, travelled to Shandong Province, a significant hub of historic and modern trade routes in China, to discuss ways to strengthen collaboration with relevant Chinese entities.

Sheikh Fahim Al Qasimi, Chairman of DGR, highlighted that the delegation’s visit to China reflects the vision of H.H. Dr. Sheikh Sultan bin Muhammad Al Qasimi, Supreme Council Member and Ruler of Sharjah, to solidify governmental relations and deepen the ties between Sharjah and Asian nations, particularly China.

The delegation aims to foster comprehensive cooperation across all sectors, leveraging successful global expertise while showcasing Sharjah’s strategic assets, its role as a representative of Emirati and Arab culture, and its notable contributions to promoting global scientific, knowledge, economic, and cultural exchange.

The delegation’s visit, concluding on 8th June, included several meetings between Sharjah officials and their Chinese counterparts. Participants include Hamad Ali Al Mahmoud, Chairman of Sharjah Economic Development Department; and Ali Mohammed Al Naqbi, CEO of Weqaya, Beeah Group.

Ahmed Obaid Al Qaseer, CEO of the Sharjah Investment and Development Authority (Shurooq); Mohammed Juma Al Musharrakh, CEO of Sharjah FDI Office; and Omar Al Mulla, Chief Investment at Sharjah Asset Management, are also present.

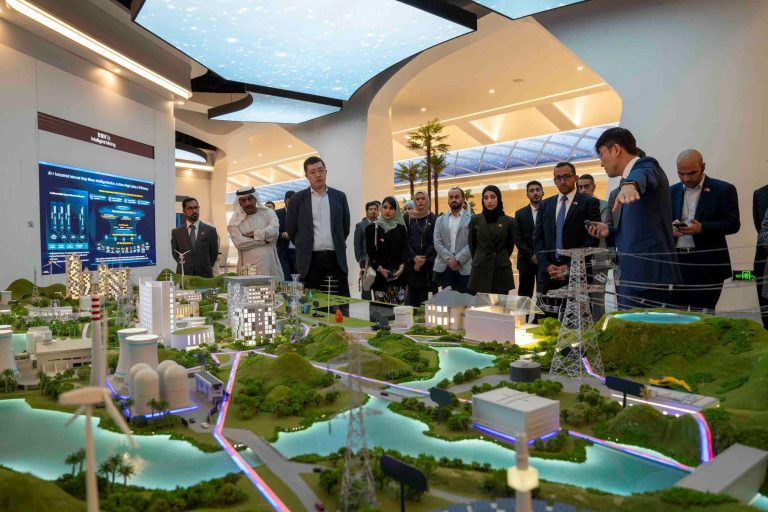

During the visit, the Sharjah delegation held several meetings regarding trade, including discussions with the China Council for the Promotion of International Trade (CCPIT) and representatives from the China Chamber of Commerce for Import and Export of Machinery and Electronic Products. These meetings centred on strengthening trade ties and exploring opportunities for mutual development.

The delegation also met with representatives from leading Chinese technology companies, such as Xiaomi, and visited the Huawei Beijing Research Centre, showcasing the emirate’s interest in fostering partnerships in the tech sector.

Additionally, DGR, Shurooq, and the Sharjah FDI Office held a meeting with Pan Asia Capital to explore potential collaboration in the business and investment domains.

In the fields of culture, tourism, and heritage, Khalid Jasim Al Midfa, Chairman of the Sharjah Commerce and Tourism Development Authority (SCDTA); Eisa Yousif, Director-General of the Sharjah Archaeology Authority; Aisha Rashid Deemas, Director-General of the Sharjah Museums Authority (SMA); Dr. Abdulaziz Al Musallam, Chairman of the Sharjah Institute for Heritage; and Marwa Obaid Al Aqroubi, Executive Director of House of Wisdom, met with representatives from the National Cultural Heritage Administration (NCHA), an administrative agency affiliated with the Ministry of Culture and Tourism of China.

The meeting, attended by Li Kun, Director of NCHA, and Wang Xiaodong, Secretary of the Palace Museum, aimed to strengthen cultural ties between Sharjah and China.

In the fields of science, technology, and education, Abdulaziz Ibrahim Al Mulla, Business Development Executive at the Sharjah Research, Technology and Innovation Park (SRTIP); Dr. Khawla Al Najjar, Associate Professor in the Department of Electrical Engineering at the University of Sharjah; Dr. Abdulrahman Al Yasi, Director of Sharjah Youth, an affiliate of Rubu’ Qarn Foundation for Creating Future Leaders and Innovators; and Khaled Al Nakhi, Director of the Sharjah Institute for Capacity Development, conducted field visits to Peking University, Tsinghua University, and the China Soong Ching Ling Science & Culture Centre for Young People.

In the healthcare sector, Sheikh Fahim Al Qasimi, Dr. Abdelaziz Saeed Obaid bin Butti Almheiri, Chairman of the Sharjah Health Authority and Sharjah Healthcare City Authority; and Dr. Abdulaziz Al Noman, Advisor to Sharjah Women’s Sports Foundation, met with representatives from the Chinese National Health Commission.

This was followed by separate meetings with Fosun International and Sinopharm representatives, which concluded with a visit to the Peking University Health Science Centre.

Regarding the aviation sector, a meeting was held between Sheikh Fahim Al Qasimi, Mohammed Rashid Al Sharif, Assistant Director of the Commercial Affairs Department at Sharjah International Airport; and Miao Qian, Director of the Civil Aviation Administration of China, as well as airline representatives, including China Eastern Airlines.

They also met with Shan Chuan, Deputy Director of the China Tourism Group, to discuss the development of mutual relations in the aviation sector, followed by a visit to Beijing Daxing International Airport.

The Sharjah programme included visits to iconic historical landmarks such as the Great Wall of China, the Forbidden City, and the Palace Museum, which boasts an impressive collection of over a million rare artefacts.